The most beautiful of investments.

On paper, diamonds offer one of the more attractive investments you can make. A high intrinsic value. Always in demand. And they really do last forever. Besides, what bank account or tracker fund sparkles quite as beautifully at a dinner party?

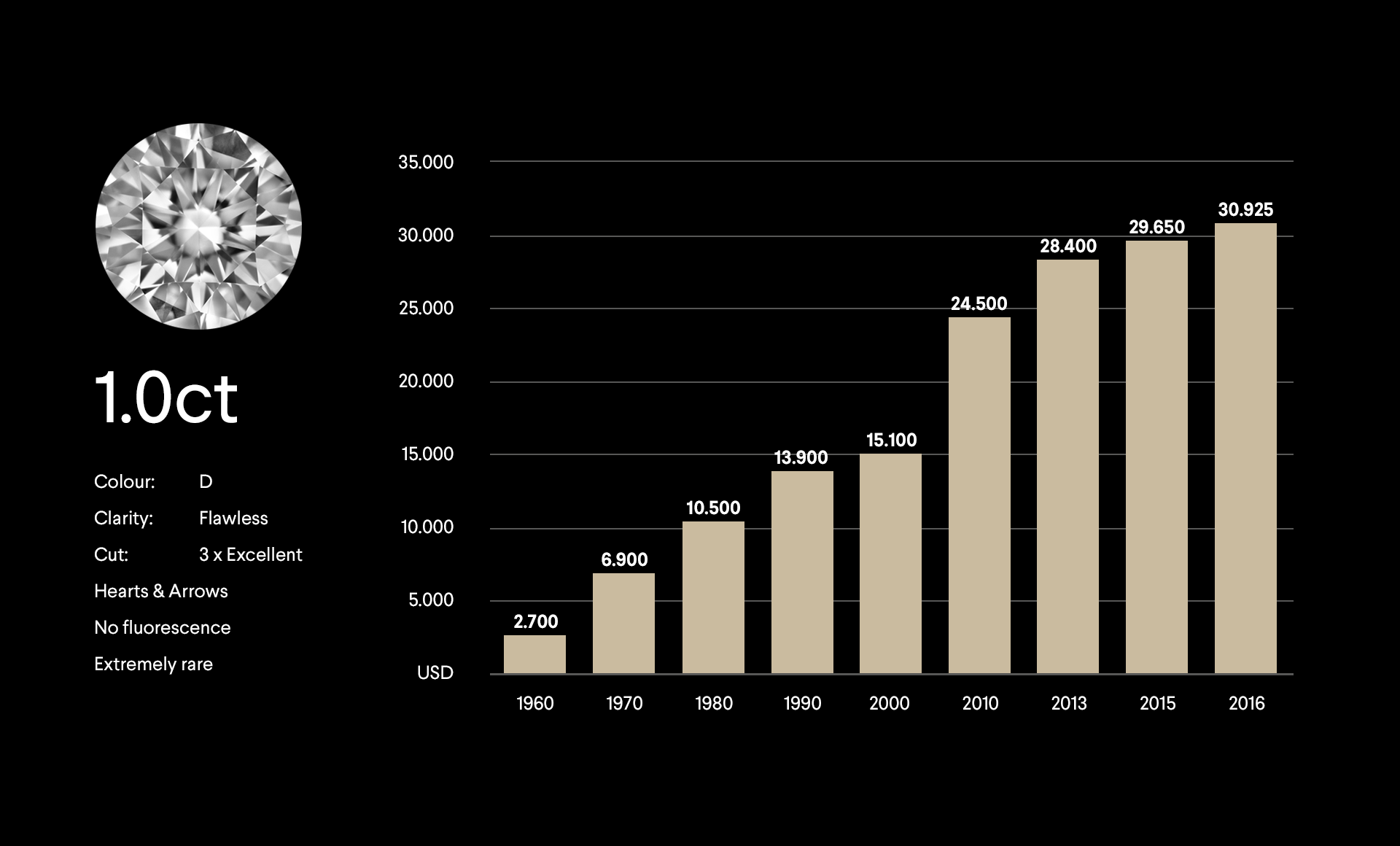

Past performance shows that diamonds increase in value over time

In 1960, the average per carat diamond price was $2,700. By 2015, that figure had risen tenfold and more to $29,650. As the demand for natural diamonds rises, known global diamond reserves just can’t keep up. In fact, forecasts project a shortfall of some 278 million carats by 2050, making it highly likely that the price per carat will continue to increase. No wonder that many people are investing in diamonds, especially when interest rates are so low and stock markets so delicate.

We don’t suggest you spend your savings on Montluc jewellery.

Like any investment, you have to be careful. Unlike gold, which is valued by weight, there is no universal price per gram for diamonds. The 4Cs all have an impact on the value. And since no two stones are exactly the same, every diamond is valued on its individual qualities.

Our 3 rules to investing in diamonds

1. Pay the right price

Remember that much of the price you pay will cover taxes, retailer markups, shop leases, staff, logistics, middlemen, etc. The Montluc online sales model removes a huge part of all that. Which means far more of your money goes on the diamond you see, rather than the expense you don’t.

» See how we keep our prices low

2. Buy the best kind of diamond

Always buy the best quality possible. Normally that would mean an Excellent or Very Good cut, complemented by above average colour and clarity. Montluc offers the very highest grades available in all categories, with our triple excellent cut going way beyond what most consider the best.

3. Buy the right kind of diamond

It’s also important to make sure your diamonds are certified, ideally by the GIA. The shape is also a key factor. Round brilliant, as used by Montluc, is by far the most popular diamond shape and so offers a larger resale market.

Think long term

Remember though, that excellent diamonds are likely to increase in value over the long-term, but they are by no means a get-rich-quick scheme.

Our advice?

Invest in the best diamonds possible. Pay the best price possible. And above all, buy it because you really, really love it.

Ask the experts

If you have any questions around buying or owning a diamond, feel free to get in touch with the » Montluc diamond advice service.

Small diamonds

Our small diamonds under 0.20ct all meet the top grades.

Colour: D-F

Clarity: Internally Flawless to VVS2

Cut: Always Triple Excellent

Large diamonds

Our larger diamonds over 0.20ct all meet the very top grades.

Colour: D

Clarity: Internally Flawless

Cut: Always Triple Excellent